Read our blog

How to Buy Your First Home with a Low Deposit Option?

Manshil Krishna Director

Why choosing the right Mortgage Broker is important

Finding the right mortgage broker can be the difference between securing the ideal mortgage and missing out on opportunities that could benefit you in the long term. Learn why choosing an experienced broker is key to simplifying the process and getting you the best deal possible.

Understanding Interest Rates: How Customers Can Save Money

Interest rates are a crucial aspect of the financial system that affect everything from mortgages and car loans to savings accounts and credit cards

Understanding the bright-line property rule

New Zealand is often said to not have a capital gains tax, however we do have some laws, like the bright-line property rule that act in a very similar manner. The bright-line rule was introduced as a way to tax the profits of residential property investors and speculators if they sell within the test period.

What are the benefits of homeownership in New Zealand?

Dreaming of owning a home? Investing in your property is not just a milestone but a rewarding journey that offers stability, financial security, and pride. In this article, you will learn the benefits of owning your home.

What is equity and how to use it to purchase another property

You must have heard a lot from work colleagues, family, or friends that they have used their existing property's equity to purchase another investment property.

The pros and cons of family and trading trusts you need to know

Discover the pros and cons of family and trading trusts in New Zealand. Learn how trusts can protect assets, manage wealth, and optimise tax planning for your financial future.

Structuring your mortgage

Establishing the right structure for your home loan is an important step in achieving your financial goals. It can provide you with the flexibility to make additional payments, reduce exposure to interest rate fluctuations and even minimise your interest costs. So, how should you structure your mortgage? Unfortunately there’s no one-size-fits-all approach as everyone’s situation and risk profile is different, however, we’ve shared some information below that our clients have found useful. For advice tailored to your situation, book in a free, no-obligation chat .

Thinking Like Bankers: Part 1

Thinking Like Bankers: Part 1 – Understanding Loan Servicing and the Loan-to-Value Ratio

Thinking Like Bankers: Part 2

Next topic we cover in our "Thinking Like Bankers" series is income assessment

The 10 best questions to ask your mortgage advisor

Are you a first-homebuyer planning to meet with a mortgage adviser? Asking the right questions can give you clarity and confidence as you navigate the mortgage process. Find out what you need to know.

The hidden costs of homeownership in NZ – what you need to know

Whether you're a first-time homebuyer or looking to upgrade, this article will help you understand the hidden costs of homeownership, help you budget effectively, and ensure a smooth transition into your new home.

Spot the perfect investment property: Pro tips for smart buyers

With interest rates coming down and bank test rates dropping, more investors are entering the market. To help you get the best value, here are some of my top tips for finding a successful investment property in New Zealand.

Mortgage 'health check'

If you have not reviewed your existing mortgages in the last 6-12 months, now would be a perfect time to get this done especially if you are coming for rate renewal in the next 6-12 months. Moving from a lower rate to a higher rate will have a significant impact to anyone's cash flow, this could effect things like going on holidays, buying a new car or even limiting your discretionary expenditure. Don't let your mortgage payments take control of your life style !

Ready to buy your first home? Financial tips to get you there sooner

For Millennials and Gen Z, stepping onto the property ladder can feel like an uphill climb in today’s economy. But with focused planning and smart strategies, owning your first home is achievable. Keep reading for some practical financial tips that will help you take the first step toward owning your first home.

Offset loans vs revolving credit: Pros and cons

Looking to accelerate mortgage repayments or structure your mortgage to align with your financial goals? Explore the benefits of revolving credit facilities and offset home loans and find the right fit for your financial objectives.

Mortgage jargon simplified for Kiwi first home buyers - Part 1

This first part of our two-part series is designed to simplify the key terms you’ll encounter in the early stages of your home-buying journey.

Mortgage jargon simplified for Kiwi first home buyers - Part 2

In the second part of our series, we’ll cover the mortgage jargon you’ll encounter as you approach the final stages of buying your first home. Understanding these terms will help you navigate this critical phase.

Is a split mortgage a good option?

If you’re a homeowner seeking mortgage management options, have you considered splitting it into tranches? Learn about the potential benefits and drawbacks of mortgage splitting before making your important decision here.

Is the Kiwi dream possible with a 5% first home deposit?

Saving a 20% deposit for your first home when rents are high and food and lifestyle costs are at record levels can feel like an insurmountable obstacle. The good news is that home ownership with a 5% deposit is possible. Keep reading to find out how.

How to refinance a home loan | Benchmark Mortgages

If you’re thinking about refinancing - to pay less interest or get a smarter loan structure - this article is for you.

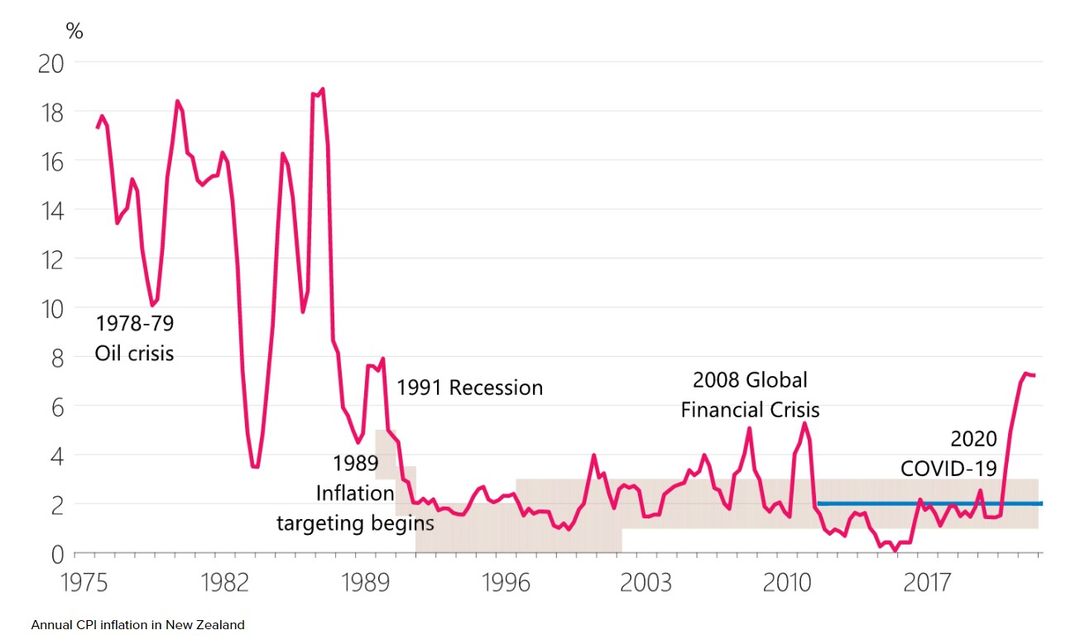

Interest rates, current rates, and forecasts!

Interest rates are a hot topic at the moment, in this blog we discuss current interest rates and forecasted interest rates in the coming years.

How to Buy Your First Home with a Low Deposit Option?

Are you ready to purchase your first home, but feeling overwhelmed by the idea of saving for a 20% deposit, especially in larger cities like Auckland?

First home? Here's why you should work with a mortgage advisor

Ready to invest in your first home and need guidance on whether to work with a mortgage advisor or not? Keep reading to explore the role of a mortgage advisor and why working with one can help you as a first-time homebuyer.

Budget-friendly ways to add value before selling your home or investment property

Discover budget-friendly tips to boost your home's value before selling. From smart updates to strategic tweaks, learn how to attract buyers and maximise your return on investment in New Zealand.

Construction funding 101 !

This blog discusses different types of construction contracts available to customers and how banks assess each particular contract for construction funding.

First Home? Don't Stress! Our simple checklist has you covered

Dreaming of owning your first home? It’s a thrilling journey, but the process can be overwhelming if you’ve never done it before. From setting your budget to completing all the paperwork, there's a lot to tackle. Follow this simple checklist, and you'll be unlocking the door to your first home in no time.

Case Study - Residential purchase and construction project

Our mission at Benchmark is to grow and protect our clients' wealth through better, smarter financial advice and the following case study is a great example of how we deliver on this. We set down with our clients, understood their short and long-term goals, and devised a strategy to secure funding for both stages.

Debt-to-income (DTI) restrictions NZ – what this means for you

In a significant development for the New Zealand property market, the Reserve Bank is set to implement new debt-to-income (DTI) restrictions on mortgage lending. Explore what DTI ratios mean, how they are calculated, and their implications for investors and first-time home buyers here:

Case Study - Construction funding for a dream holiday home !

At Benchmark we want the process of securing funding to be as seamless as possible and this is what our clients experienced when they were on holiday overseas for several months while we secured the funding and got their project underway.

5 tips for self-employed first-time home buyers

Being self-employed offers numerous advantages and freedom. However, it also comes with added pressure and responsibilities if you want to get on the property ladder. If you are self-employed and looking to buy your first home, here are five essential tips to navigate the process successfully.